Thought Leadership

July 2025

Navigating Obligations: Europe's Race to 50 MT of CO2 Storage by 2030

The European NZIA (Net Zero Industry Act) have set an objective of making 50 million tons of CO2 storage capacity available annually by 2030. With only five years before the target should be met, and only around 1.75 million tons per annum (MTPA) of capacity currently available in the wider European economic area, primarily Norway, a significant effort is required in the coming years to bring additional storage capacity online in Europe. To meet this objective, the European commission has proposed imposing obligations on a portion of oil and gas producers in Europe, placing responsibility on producers for delivering eligible carbon storage, equivalent to the 2030 storage capacity objective.

How were the obligations assigned?

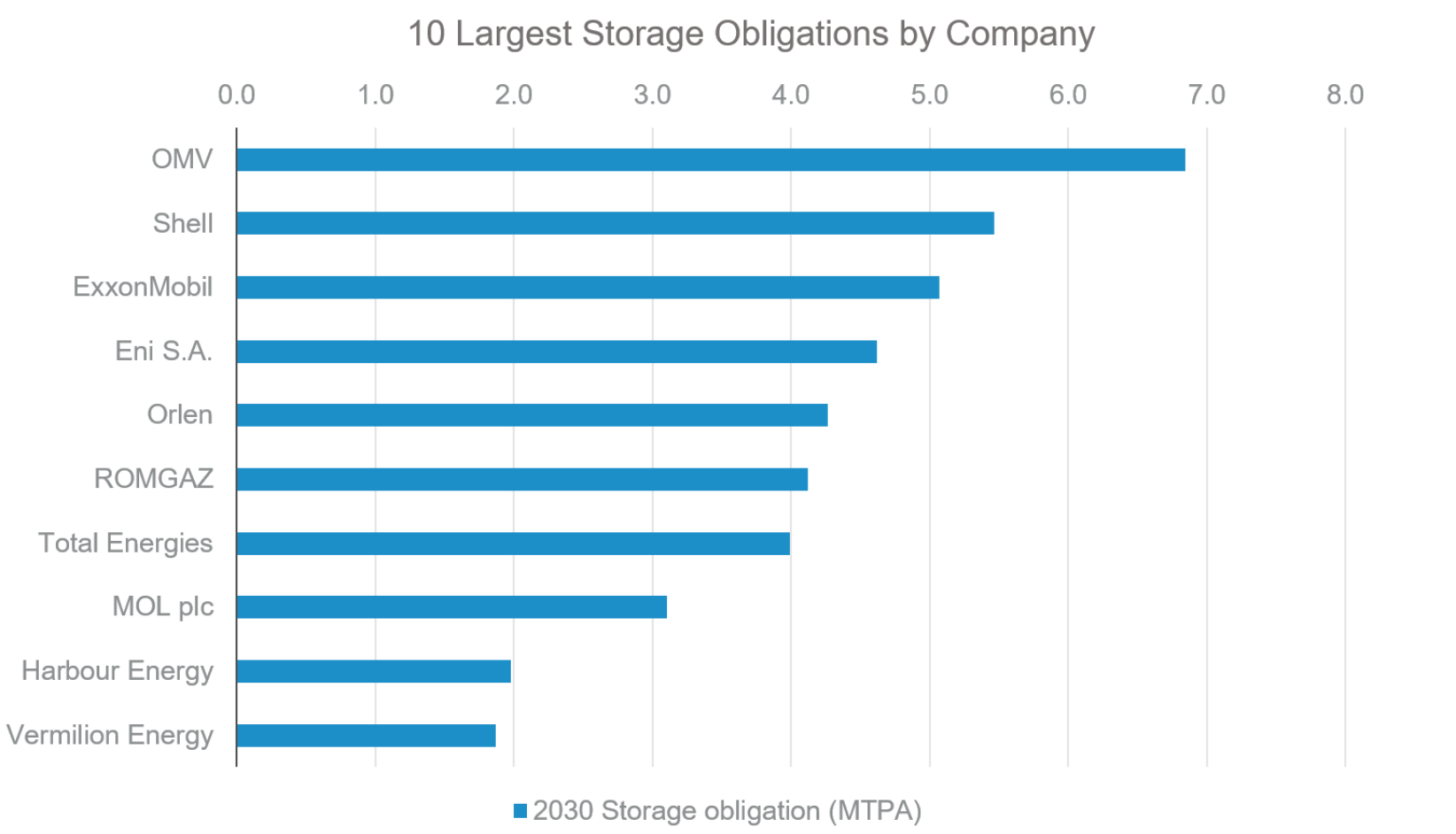

Obligations were allocated based on each oil and gas producer’s share of EU crude oil and natural gas production, using output data from 2020 to 2023. The intention of this approach was to ensure that fossil fuel producers contribute equitably to the development of carbon storage infrastructure. These obligations are enforced by the national authorities of each member state and align with a broader initiative to enhance transparency in reporting carbon capture and storage (CCS) activities.

A total of 44 entities involved in oil and gas production since 2020 have been identified as obligated entities, and have each produced at least 610 kilotons of oil equivalent between 2020 and 2023. A total of 44 entities, involved in oil and gas production since 2020, have been identified as obligated entities. Many of these are subsidiaries, or joint venture partnerships of larger companies, so for analysis purposes, these obligations have been attributed to their parent companies. The 10 parent companies with the most significant 2030 obligations are highlighted below.

Member State Responsibilities

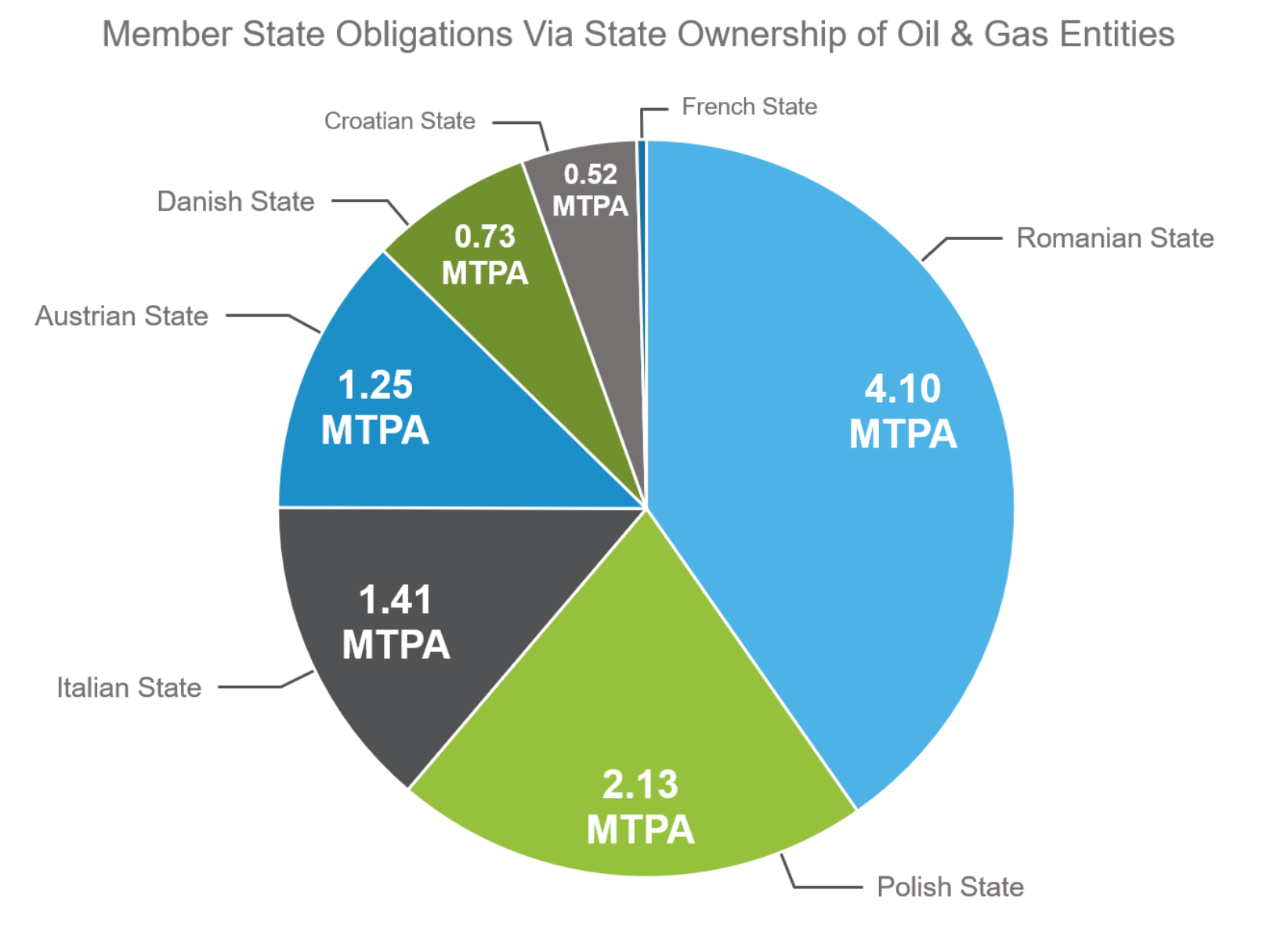

It is the responsibility of member states to enforce the storage obligations. Interestingly, our analysis shows the significant stake many member states themselves have in European petrochemical production. Specifically, 13 out of the 44 obligated entities have member state ownership. For our analysis, we have represented each member state's stake in the obligations as a proportion of their ownership in these entities. Collectively, member states hold approximately 20% of the total 2030 obligations in this analysis. Notably, Romania and Poland have the highest stakes due to their partial ownership of entities like OMV Petrom, S.N.G.N ROMGAZ, and Orlen S.A., which carry substantial obligations.

While it remains the responsibility of the obligated entity to deliver on their obligations, the significant financial interests and direct involvement of member states in certain entities may encourage additional policy support within these countries for developing CO2 storage capacity.

Obligation Reporting

Under the delegated regulation published on 22 May 2025, obligated entities are required to submit a storage plan report to the European Commission by 30 June 2025, outlining how they plan to meet their CO2 storage obligations. Importantly, these entities are not obligated to develop the storage capacities entirely on their own, and are encouraged to form agreements with other entities to support storage capacity projects collectively. With the due date for the storage plan reached, and the timeline for submission being relatively tight, it will be interesting to follow the extent each entity has committed, or plans to commit, to the development of new and existing carbon storage projects in Europe. It will also be enlightening to learn which publicly announced storage projects are going to be used to meet the 2030 target, and if any additional collaborations form as a result.

Potential Challenges

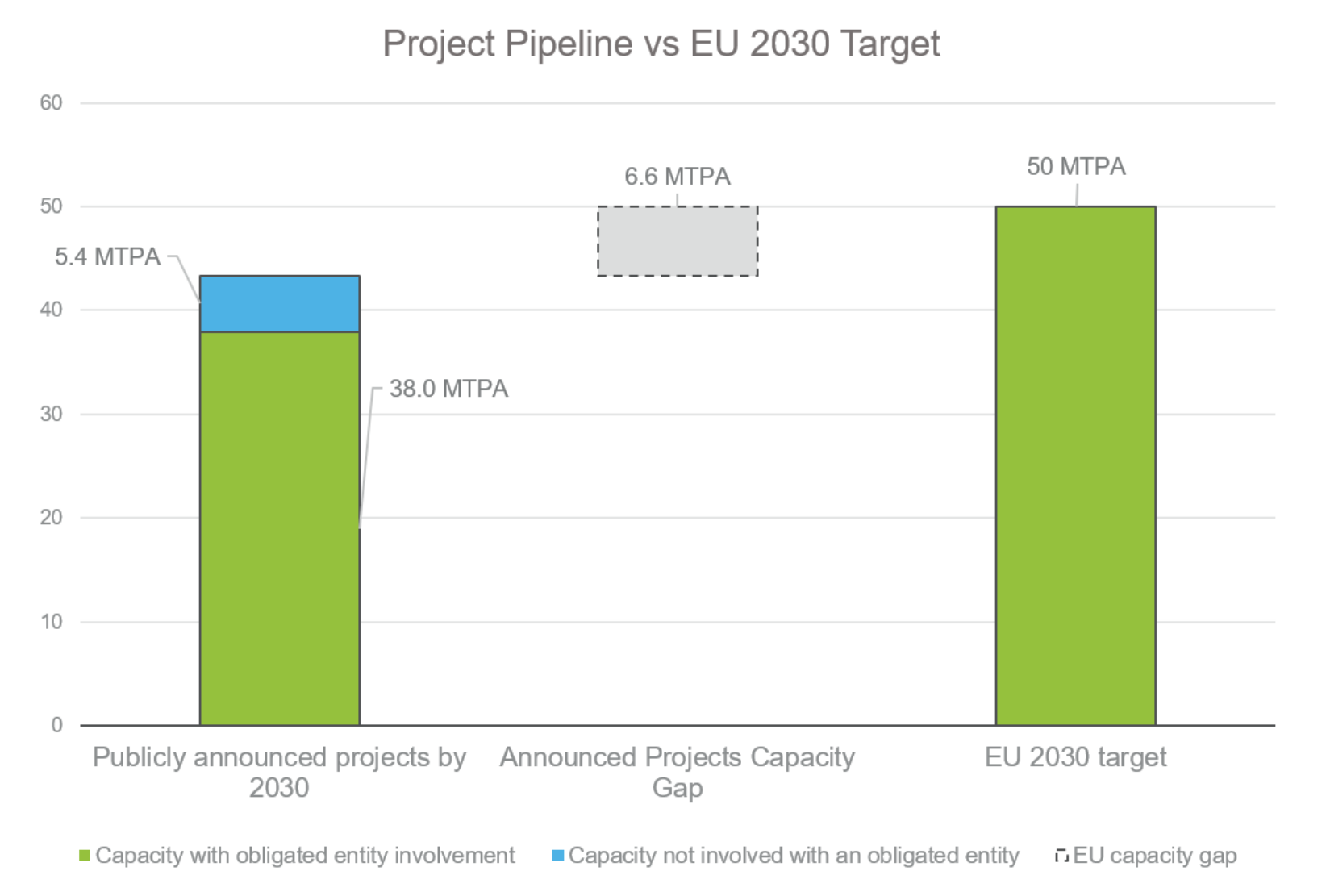

Optimistic estimates of carbon storage in the EU by 2030 suggest at least a 6.6 MTPA capacity shortfall from the 2030 target, based on publicly announced injection timelines of European carbon storage projects. Of the projected available capacity, around 38 MTPA involves current participation from at least one obligated entity. Therefore, in order to meet the 50 MTPA EU target, additional storage capacity will need to be made available. It will be crucial for projects to balance technical and commercial objectives. On one hand it may be desirable to increase the initial injection capacity for existing carbon storage projects, perhaps through accelerating the pace towards expansion phases or bringing additional storage areas into projects. However, even if storage projects have expansion volumes planned, it may not be technically possible to bring stores online with higher injection capacity. A controlled ramp up of injection volumes can be important to allow learnings to be made and develop the projects' technical maturity in a controlled manner. Therefore, the need for new carbon stores may be unavoidable, and it may not be possible to meet the 2030 target through commercial agreements involving existing storage projects alone.

The EU target to increase the available storage capacity in Europe could help overcome some of the current challenges, such as the lack of a competitive merchant market, with current carbon storage projects set to come online with dedicated anchor emitters. Mandating the development of additional storage, regardless of available emissions, could lower the cost for emitters as it would reduce storage scarcity. This would further benefit smaller emitters and could also help accelerate the development of transport and storage or aggregation business models if set volumes of storage capacity become a certainty. However, this kind of regulation is not without its problems, as mandating the development of storage regardless of available emissions could make the storage projects less economical. One solution is to meet storage obligations whilst collaborating with CO2 aggregators and transport providers to ensure there continues to be access to sufficient volumes of emissions, which matches or exceeds the increased capacity.

Carbon Storage Obligation Challenges

Assigning responsibility for delivering carbon storage capacity is not without its challenges, particularly for companies not already involved in carbon storage development or without the ability to develop storage capacity in their country of operation.

Timeline and planning challenges

The European commission decision only gives obligated entities one month to deliver a report outlining how they intend to meet their obligations. For those already engaged in carbon storage projects, this could involve outlining enhancements to current storage projects with respect to the final investment decisions (FID) and projected injection dates. However for entities not involved in carbon storage already, and with potentially large obligations to now meet, one month to prepare a plan may not be enough time to make the appropriate decisions, especially if new projects need to be developed. Developing new carbon capture and storage project from scratch to first injection within four and a half years poses significant challenges, given the delays and obstacles existing projects still face.

Uneven Regulatory Playing Field

Since obligations are to be enforced by member states, there is a risk that penalties may be inconsistent between regions, resulting in more or less severe penalties faced by different obligated entities depending on where they are located. There are also potential conflicts of interest arising from partial state ownership, which may exacerbate discrepancies between the penalties faced. There is further concern that basing the obligations on historic production volumes puts disproportionate stress on entities whose production is in decline and therefore do not have the revenue to support storage projects. In addition, Some entities are already supported by the European Union to stay operational in the name of domestic energy security, and so their productivity is not representative of their capability to invest in carbon storage, without further financial support.

Technical Challenges

Obligated entities, particularly those only with onshore production capacity, face significant technical challenges to developing carbon storage capacity. Onshore carbon storage is not legal in many European States meaning that they certain entities would need to partner with offshore projects where their expertise and existing business relationships are less transferrable. In addition, even if suitable and legal onshore storage locations are identified, many of the onshore depleted gas fields (particularly in eastern Europe) are located remotely from emitters, meaning carbon storage projects located here would find it more economically challenging to access the majority of European emissions.

Potential Solutions

The European Commission has encouraged obligated entities to form partnerships to deliver their obligated capacity. Since entities can meet their obligations by investing into storage capacity of existing projects, one solution could be to fund the expansion of storage projects, or take on some of the risk associated with carbon storage exploration to develop new stores to tie in with existing storage projects. However, entities with existing storage projects underway may not be inclined to introduce new partners to projects, reducing their own stake. On the other hand this may be mutually beneficial as risk would be more widely distributed.

To address regulatory challenges, a unified compliance and penalty framework could be established or recommended, ensuring consistency across member states. The direct state ownership of some obligated entities might further encourage carbon storage development by promoting local regulatory support for CCS initiatives.

Due to the nascent nature of the onshore carbon storage market in South East Europe as well as the CO2 supply challenges, it is highly unlikely that significant CO2 storage capacity will be available in countries like Romania and Poland by 2030. Therefore the technical challenges faced by some entities would be more suitably overcome through partnerships in regions with more developed CCS projects. Therefore, more clarity from the European Commission on how these partnerships can be formed and supported could be helpful.

As these storage projects develop and we learn more about the plans each entity makes to reach their obligation by 2030, Goal7 will be continuing to analyse the effect these advancements could have on the European carbon storage market. If you are interested in learning more about how we are involved in CCS, head on over to the case studies section of our website.